Global society is making progress in funding solutions to challenges such as climate change and poverty. By 2025, environmental, social and governance -related investments are expected to more than double to about $50 trillion.footnote1 This growing wave of sustainable finance is helping fund renewable energy facilities, increase sustainable food production, advance technological breakthroughs and more. The challenge now is to get capital to where it’s needed most, and an approach known as blended finance is helping the public, private and nonprofit sectors collaborate on projects that would otherwise be very difficult to get off the ground.

What is blended finance, and why it matters

Blended finance lets investors choose different risk tolerances while all participating in the same project. Often used in real estate transactions, it is also proving to be an effective way to get capital to critical, but hard-to-fund projects. The approach can bring together philanthropy, government funding and private sector investors with different risk and return expectations. Those willing to take more risk can act as a capital cushion for investors who need to take less risk but are interested in financing high-impact projects.

This kind of flexibility is especially important when considering developing nations, where sustainable finance could have an outsized impact on social and environmental issues. Increasingly, the mission for leaders looking to address sustainability and equality issues is to innovate how to get help to where it’s most needed, and in ways that benefit everyone. For example, as of 2021, developed nations lead the way in making the transition to an economy powered by renewable energy sources.footnote2 To some extent, this is because in developing nations it is more difficult to fund critical projects: Risks are higher, markets are not as mature and there is greater instability to contend with. And yet, developing nations could benefit most from sustainability efforts and economic opportunity. “The world has trillions of dollars to invest, but the question is, can you get it organized?” says Brian Moynihan, chairman and chief executive officer of Bank of America. “We have to mobilize the entire capitalist system to move the needle on challenges this large.”

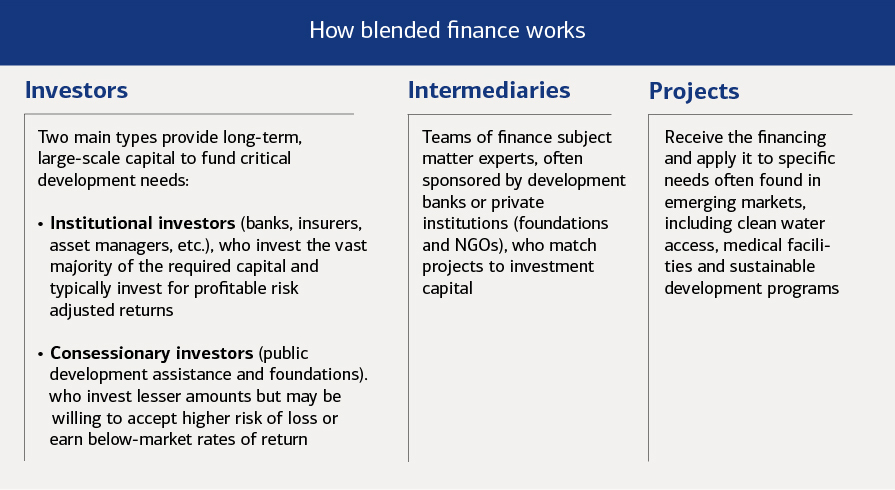

Investors

- Two main types provide long-term, large-scale capital to fund critical development needs:

- Institutional investors (banks, insurers, asset managers, etc.), who invest the vast majority of the required capital and typically invest for profitable risk adjusted returns

- Concessionary investors (public development assistance and foundations), who invest lesser amounts but may be willing to accept higher risk of loss or earn below-market rates of return

Intermediaries

- Teams of finance subject matter experts, often sponsored by development banks or private institutions (foundations and NGOs), who match projects to investment capital

Projects

- Receive the financing and apply it to specific needs often found in emerging markets, including clean water access, medical facilities and sustainable development programs

A CrossBoundary Energy Access solar mini-grid in Rokota, Nigeria.

Take, for example, CrossBoundary Energy Access, which is working to provide clean energy to 1 million people in Africa through the development of solar-powered mini-grids. Such power sources can help communities that are too far away from the grid to be connected. The International Energy Agency estimates that 600 million people on thefootnote3 continent do not have access to electricity, putting a brake on economic growth, productive investment, job creation and poverty reduction. Solar mini-grids can help provide clean, renewable energy, and, in doing so, open up education, health and economic opportunities. “Our investment is supporting clean energy solutions in rural, hard to reach areas of Africa,” says Amy Brusiloff, community development executive for Environmental, Social and Governance at Bank of America. “This innovative blended finance structure aggregates renewable energy mini-grid projects to achieve scale and reduce risk, which more readily enables large institutions to invest.”

Bamboo Capital’s ABC Fund finances sustainable and climate-resilient agriculture projects.

Bank of America also invested in Bamboo Capital’s Agri-Business Capital (ABC) Fund. A blended finance fund, ABC provides capital for sustainable and climate-resilient agriculture and agribusiness to farmer organizations. “The ABC Fund is unlocking capital to build a more sustainable agricultural sector and meet the needs of rural farmers,” says Dan Letendre, managing director of Environmental, Social and Governance at Bank of America “The fund will help to address the impacts of climate change on rural farming as well as drive more innovation in the sector to help meet the United Nations Sustainable Development Goals.”

WaterCredit Investment Fund 3, an innovation of WaterEquity, is a $50 million blended fund providing debt financing to meet the water and sanitation needs of families living in poverty in Asia.

The fund is expected to empower 4.6 million people in South and Southeast Asia with access to safe water and/or sanitation.

Since 2003, WaterEquity has deployed $200+ million to help 3.3 million people gain access to clean water and sanitation services.

The average loan size is $362, and the repayment rate is greater than 99%. For WCIF3, 93% of borrowers are women.

Goals at a global scale

As promising as such projects are, they represent just the start of blended finance’s potential to unlock trillions of dollars to address a wide range of issues, such as those outlined in the United Nations Sustainable Development Goals (SDGs.) In supporting those goals, the World Bank Group is promoting a variety of innovative, public-private financing approaches structured so that private investors may choose among various levels of risk and potential reward.

There’s the potential to mobilize vast amounts of capital.

When the World Bank Group, other development banks and global financial institutions such as Bank of America use their resources not just to make direct loans and other financing structures for development, but to leverage other investors — that’s when capital can start building to a scale equal to the world’s challenges. “A single project can benefit from the combining of different investor risk tolerances and expected rates of return,” Moynihan says. “That’s what blended finance is about. There’s the potential to mobilize vast amounts of capital without sacrificing private capital returns.”

To help move that process along, in 2018 Bank of America announced an initial allocation of $60 million to create the Blended Finance Catalyst Pool, which supports climate resiliency and access to clean energy, affordable housing and water and sanitation. Bank of America co-invests with development banks, foundations, institutional and private equity investors and other financial institutions to scale funding that addresses the SDGs.

Since 2007, Bank of America has provided more than $350 billion to environmental sustainability. Learn more about Bank of America’s commitment to transitioning to a more sustainable economy and its efforts to realize social equality. These include a new goal of mobilizing and deploying $1.5 trillion in sustainable finance capital by 2030 in support of the SDGs.

Bloomberg Intelligence, “ESG 2021 Midyear Outlook,” July 2021.

BloombergNEF, “Energy Transition Investment Trends 2022,” January 2022.

IEA, “Africa Energy Outlook 2022,” June 2022.

3/1/2023

Explore more

Sustainable Aviation Fuel: Ready for Takeoff

Corporate environmental sustainability strategy & initiatives