We're committed to strengthening our communities. See how we're making an impact.

We learn what matters most by asking you one simple question: What would you like the power to do?

Proud supporter of every goal

Teaming up to support achievements in the game of soccer, and across our community.

No matter what your financial goals are, we’re here to help

We’re helping support communities impacted by the wildfires

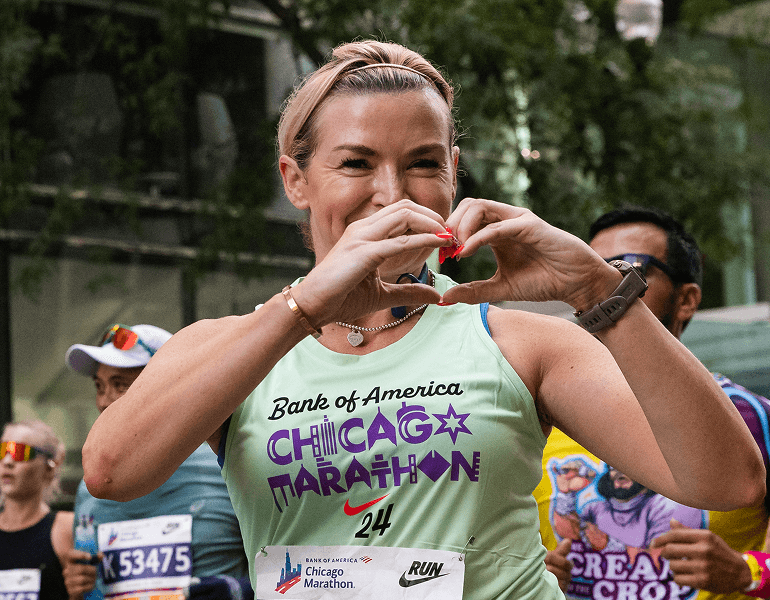

More than a race

2024 Bank of America Annual Report

Helping clients achieve their financial goals

For four years in a row, J.D. Power has certified Bank of America for Outstanding Customer Satisfaction with Financial Health Support – Banking & Payments. ***

Pursuing and enabling the dreams of entrepreneurs

Entrepreneurs enhance the character of cities and towns across our country. Take the founder behind Isla Veterinary Boutique Hospital. Dr. Josh Sanabria started his own veterinary hospital in Dallas, Texas – and we've supported his endeavors from day one.

Owner Josh is just one of the three million small business owners that we work with every year, helping them realize their potential.

Hero image: Natalie J., Financial Center Market Manager

*** J.D. Power 2025 Financial Health Support CertificationSM is based on exceeding customer experience benchmarks using client surveys and a best practices verification. For more information, visit www.jdpower.com/awards