Bank of America Corporation and its subsidiaries comprise a global financial services firm (BofA). BofA makes the following disclosures pursuant to The California Voluntary Carbon Market Disclosures Act (VCMDA) requiring businesses to disclose certain information if they do any of the following:

- Market or sell voluntary carbon offsets within the State of California;

- Purchase or use voluntary carbon offsets that make claims regarding the achievement of net zero emissions, claims that the entity, related entity, or a product is “carbon neutral,” or make other claims implying the entity, related entity, or a product does not add net carbon dioxide or greenhouse gases to the climate or has made significant reductions to its carbon dioxide or greenhouse gas emissions; and

- Make claims regarding the achievement of net zero emissions, claims that the entity, a related or affiliated entity, or a product is “carbon neutral,” or makes other claims implying the entity, related or affiliated entity, or a product does not add net carbon dioxide or greenhouse gases to the climate or has made significant reductions to its carbon dioxide or greenhouse gas emissions.

Under Section 1.Part 10 (commencing with Section 44475), the VCMDA requires businesses marketing or selling voluntary carbon offsets (VCOs) within the State of California to disclose certain key information. As of the date of this disclosure, certain BofA subsidiaries engage in the marketing or selling of VCOs, both within and outside the state, in the capacity of market-maker in environmental commodities. Those BofA entities are registered swap dealers under the Commodity Exchange Act, are regulated by the Commodity Futures Trading Commission, and engage in trading as principal in VCOs and similar products, through swaps, plain vanilla options, futures, spot, and forward transactions. These VCO transactions are traded either on an exchange or on an over-the-counter basis with sophisticated counterparties who meet applicable regulatory standards as evidence of such sophistication. BofA has in place an enterprise-wide set of standards and requirements to verify the identity of its counterparties and onboard those buyers in accordance with legal and regulatory standards prior to the engagement in any VCO transaction. Any carbon offset project which produces VCOs that BofA would market or sell will be registered on one of the following registries and therefore, the VCOs will be developed and metrics calculated according to the particular standards and protocol of that registry, including, but not limited to, the estimated emissions reductions or removal benefits:

Potential additional registries, as demand arises.

In its role as principal and market-maker, BofA transacts almost exclusively in the secondary market with respect to VCOs and does not necessarily have a direct contractual relationship to the developer. As such, BofA relies on the information provided by the developer to the applicable registry and has no knowledge of the traded VCO beyond that which is available to the public on the registry. In addition, BofA does not represent to the market or to the potential or actual buyer that it has any additional information with respect to a particular VCO beyond that which is publicly available on the applicable registry. As principal in the trading of VCOs, BofA does not serve as an agent, fiduciary, advisor or any other similar capacity to the market, including to potential or actual buyers of VCOs. In this role, BofA does not provide financial or investment advice or specific recommendations to the market or to potential or actual buyers. In addition, BofA does not provide representations or warranties as to merchantability or fitness for purpose. Project-specific information, including the project identification number, if applicable, is provided directly by BofA to its buyer no later than at the time of settlement of the applicable purchase/sale transaction.

With respect to any VCO which BofA stands positioned and ready to market or sell within the State of California, the following details regarding the VCO (and potentially others) are typically made available by the registry that evaluated the offset on its publicly available website, for the particular project in question as required in 44475(a)(1-10); 44475(b)(1-2); and 44475(c):

(1)The protocol used to estimate emissions reductions or removal benefits from the particular project is located on the registry website under “methodology,” “standard,” or similar and associated terms.

(2)The location of the particular project is publicly available using the applicable registry link above and navigating to “State/Province,” “Project Site Location,” or similar and associated terms.

(3)The project timeline is located on the registry website under the “crediting period,” “Current Crediting Period Start Date,” “Current Crediting Period End Date,” “Project Timeline,” or similar and associated terms.

(4)The date when the project started or will start is located on the registry website under “crediting period term,” “Start Date/Offset Project Commencement,” or similar and associated terms.

(5)The dates and quantities when a specified quantity of emissions reductions or removals started or will start, or was modified or reversed is located on the registry website under “Crediting Period Term”, “crediting period term,” “canceled offset credits,” “GHG Project Plan,” or similar and associated terms.

(6)The type of project, including whether the offsets from the project are derived from a carbon removal, an avoided emission, or, in the case of a project with both carbon removals and avoided emissions, the breakdown of offsets from each, is stated or inferred from information located on the registry website under the particular noted “Project Type,” within verification and filing documents, “GHG Project Plan,” or similar and associated terms.

(7)Whether the project meets any standards established by law or by a nonprofit entity is located on the registry website under the methodology/standards/status term, “Compliance Program Status,” or similar and associated terms.

(8)Relevant information, if available, regarding the durability period for any project that the seller knows or should know that the durability of the project’s greenhouse gas reductions or greenhouse gas removal enhancements is less than the atmospheric lifetime of carbon dioxide emissions, would reside in varying locations on the registry website, including but not limited to, the miscellaneous documents posted by the project to the registry website, including the “GHG Project Plan,” or similar and associated terms.

(9)Whether there is independent expert or third-party validation or verification of the project attributes would be per the registry standards available on the registry website, and if specified, may be located on the registry website under the listing of the project validator, verifier, or similar and associated terms.

(10)Emissions reduced or carbon removed on an annual basis is located on the registry website under the estimated annual emissions reductions section, the “GHG Project Plan,” or similar and associated terms.

(11)Details regarding accountability measures if a project is not completed or does not meet the projected emissions reductions or removal benefits would be available in the registry’s protocol and noted in the buffer pool account balance, Project Plan, and canceled offset sections, as applicable.

(12)The pertinent data and calculation methods needed to independently reproduce and verify the number of emissions reduction or removal credits issued using the protocol would be available from the materials available on the registry website.

Under Section 44475.1, the VCMDA requires an entity that purchases or uses voluntary carbon offsets that makes claims regarding the achievement of net zero emissions, claims that the entity, related entity, or a product is “carbon neutral,” or makes other claims implying the entity, related entity, or a product does not add net carbon dioxide or greenhouse gases to the climate or has made significant reductions to its carbon dioxide or greenhouse gas emissions, disclose all of the following information pertaining to each project or program on the entity’s internet website:

(a) The name of the business entity selling the offset and the offset registry or program.

(b) The project identification number, if applicable.

(c) The project name as listed in the registry or program, if applicable.

(d) The offset project type, including whether the offsets purchased were derived from a

carbon removal, an avoided emission, or a combination of both, and site location.

(e) The specific protocol used to estimate emissions reductions or removal benefits.

(f) Whether there is independent third-party verification of company data and claims listed.

Since 2010, we have reduced our location-based GHG emissions by 62% and in 2019, we achieved carbon neutrality for our operations, one year ahead of our goal. To reach and maintain carbon neutrality for Scopes 1 and 2 GHG emissions, we reduce our location-based emissions, purchase all of our electricity from renewable sources and for our residual market-based emissions, we acquire a small number of carbon credits registered on one of the registries listed above (VCS, GS VER, CAR, ACR). These registries follow best practices of high-integrity carbon credits, including project methodologies aligned with best-available science and independent third-party verification of all carbon credits.

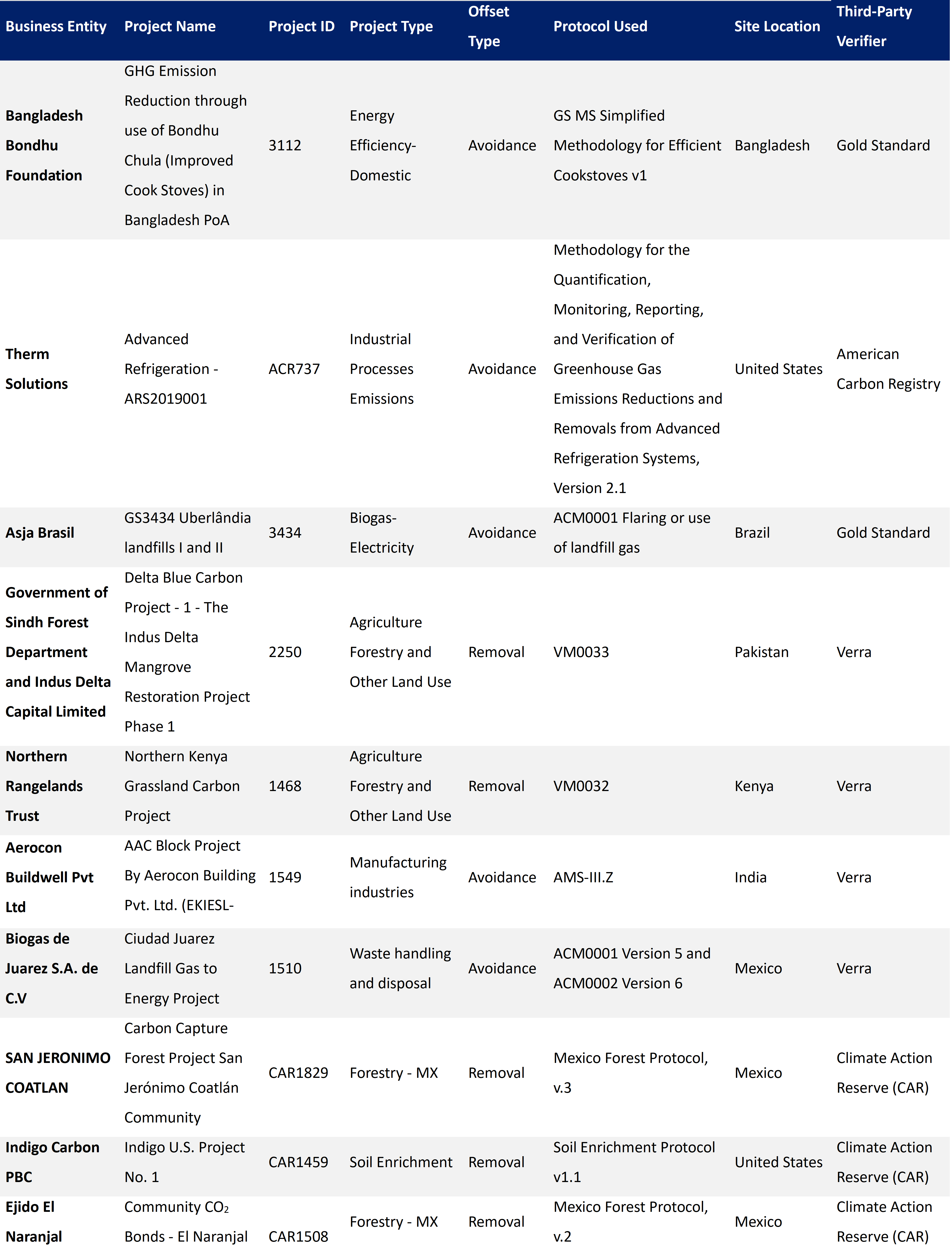

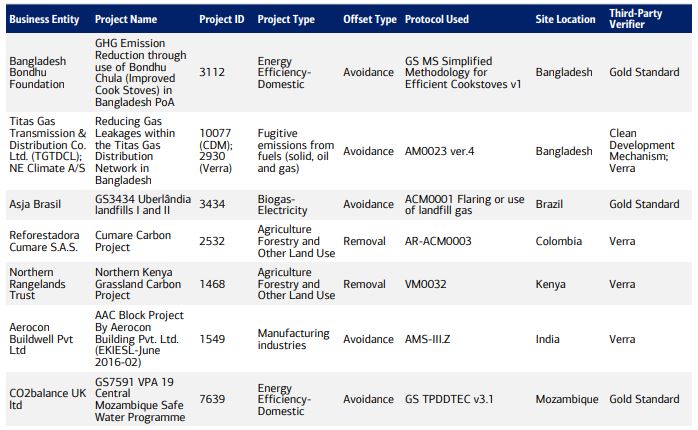

Information about the carbon credits purchased to address 2023 residual Scope 1 and Scope 2 GHG emissions and Scope 3 business travel emissions as provided by each registry and program is included below as listed in 44475.1(a)-(f) for carbon credits retired in 2023:

Under section 44475.2, the VCMDA requires an entity that makes claims regarding the achievement of net zero emissions, claims that the entity, a related or affiliated entity, or a product is “carbon neutral,” or makes other claims implying the entity, related or affiliated entity, or a product does not add net carbon dioxide or greenhouse gases to the climate or has made significant reductions to its carbon dioxide or greenhouse gas emissions disclose on the entity’s internet website all of the following information pertaining to all greenhouse gas emissions associated with its claims:

- All information documenting how, if at all, a “carbon neutral,” “net zero emission,” or other similar claim was determined to be accurate or actually accomplished, and how interim progress toward that goal is being measured. This information may include, but not be limited to, disclosure of independent third-party verification of all of the entity’s greenhouse gas emissions, identification of the entity’s science-based targets for its emissions reduction pathway, and disclosure of the relevant sector methodology and third-party verification used for the entity’s science-based targets and emissions reduction pathway.

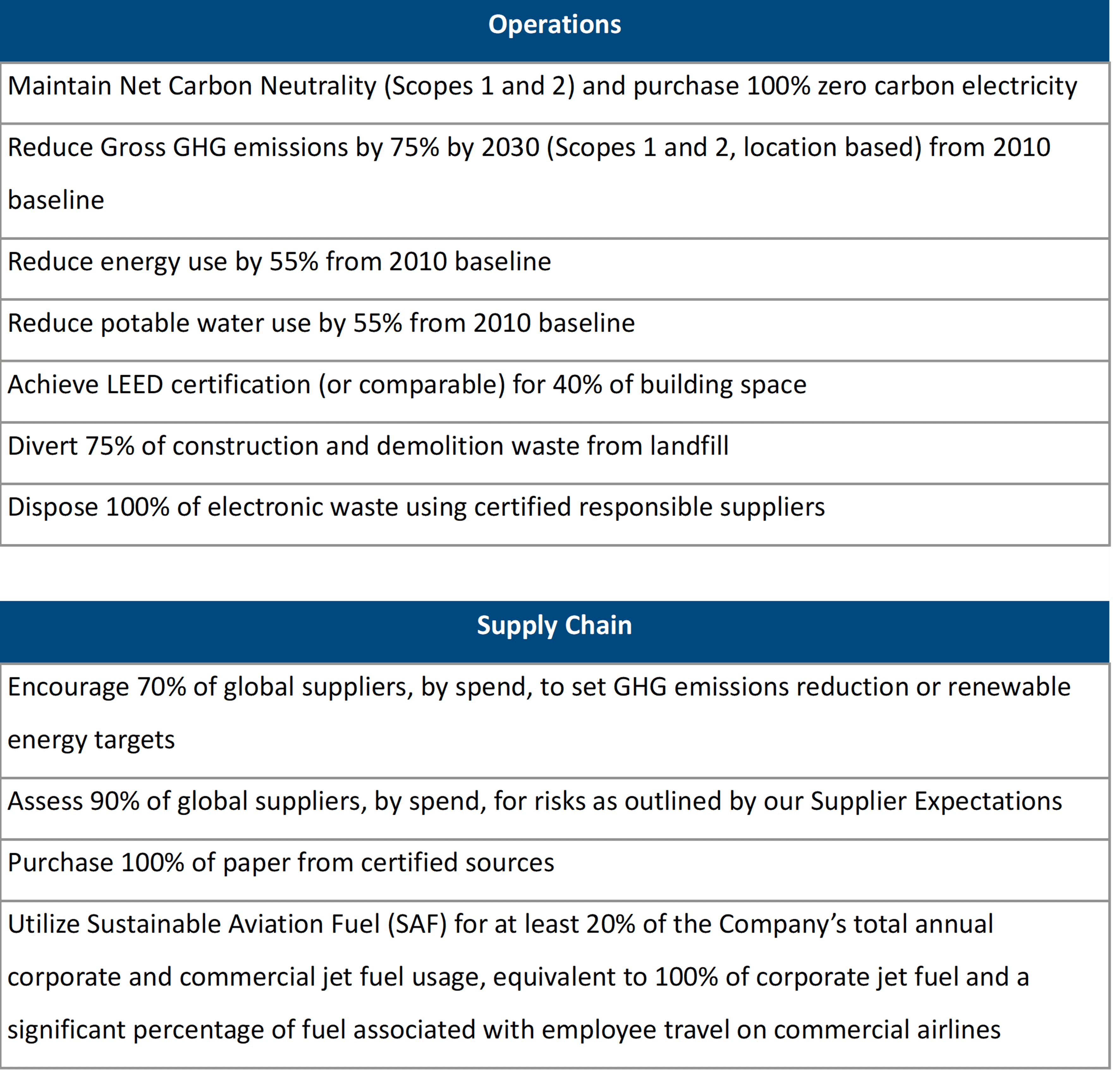

- In 2021, we established a set of interim targets for our operations and supply chain to be achieved by 2030, including:

- Maintain carbon neutrality for operations (Scope 1 and 2)

- Purchase 100% zero carbon electricity

- Reduce location-based GHG emissions by 75% (Scope 1 and 2)

- Reduce energy use by 55%

- We measure our progress towards these goals each year, and report our progress in our Sustainability at Bank of America document.

- In order to achieve carbon neutrality, BofA purchases and retires an appropriate number of renewable energy credits (RECs) and carbon credits to match our electricity usage and emissions, respectively, each year.

- Greenhouse gas emissions information is assured by Apex Companies, LLC. (“Apex”), an independent third-party verifier. All elements of the company's carbon neutrality claims are assured through the third-party assurance process.

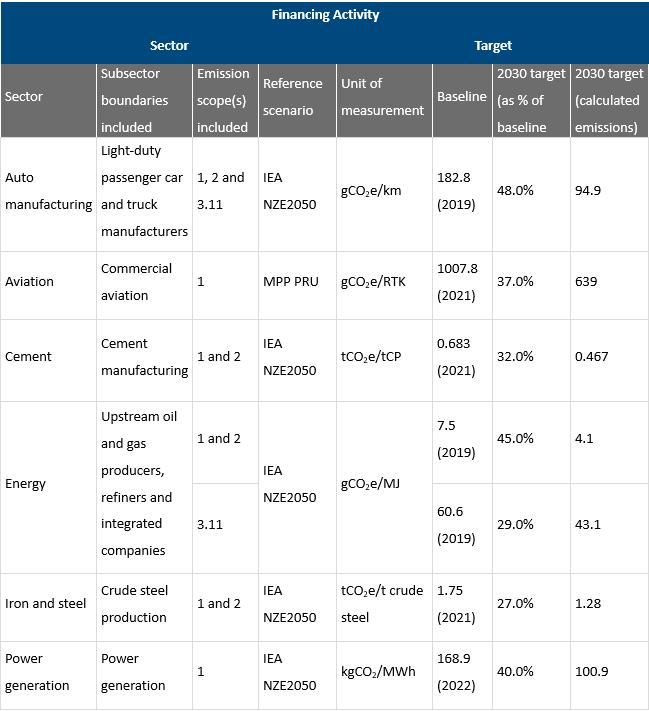

Reference: For information on BofA’s commitment to achieve net zero emissions before 2050, including interim 2030 targets, our approach to target management, the methodologies we use, and our annual attestations please refer to the Strategy and Metrics & Targets sections (pages 16-56; 68-90) of Sustainability at Bank of America.

- Whether there is independent third-party verification of the company data and claims listed.

BofA engaged Apex to provide assurance of selected environmental and social data reported in its Sustainability at Bank of America document. Apex performed its work in accordance with its standard procedures and guidelines for external Assurance of Sustainability Reports and International Standard on Assurance Engagements (ISAE) 3000 Revised, Assurance Engagements Other than Audits or Reviews of Historical Financial Information (effective for assurance reports dated on or after Dec. 15, 2015), issued by the International Auditing and Assurance Standards Board. A copy of Apex’s 2023 independent reasonable and limited assurance statement ("Environmental and Social Assurance Statement") is available on pages 110-117 of Sustainability at Bank of America.

Additional Disclosure

This document should not be used as a basis for trading in the Company’s securities or the securities or loans of any of the companies named herein or for any other investment or voting decision. The information contained in this document does not constitute and is not intended as a recommendation and/or an offer or the solicitation of an offer to buy any securities, purchase or sell any financial instrument, equity product or other investment, or as an official confirmation of any transaction or a recommendation for any investment product or strategy. Additionally, such information does not constitute a commitment, undertaking, offer or solicitation by any Company entity to underwrite, subscribe for, or place any securities or to extend or arrange credit or to provide any other products or services to any person or entity. Historical data shown represents past performance and does not guarantee comparable future results. The information and any examples provided in this document are illustrative and none of the Company or its affiliates is endorsing any particular approach to ESG, any particular ESG investment strategy or any particular ESG standards, ratings or metrics by including such information in this document.

Any third-party information contained in this document or otherwise used to derive information in this document is believed to be reasonable and reliable, but no representation or warranty is made as to the quality, completeness, accuracy, fitness for a particular purpose or non-infringement of such information. In no event shall the Company be liable (whether in contract, tort, equity or otherwise) for any use by any party of, for any decision made or action taken by any party in reliance upon or for any inaccuracies or errors in, or omissions from, such information. Any sources of third-party information referred to herein retain all rights with respect to such data and use of such data herein shall not be deemed to grant a license to any third party. Any use of or reference to third-party brand names, trademarks, service marks, business descriptions or case studies is for informational purposes only and does not imply a referral, recommendation or endorsement by the Company or its affiliates or that such third party has authorized the Company or its affiliates to promote the third party’s products or services. Case studies are provided for illustrative purposes only, are not intended to make any representations as to environmental and sustainability initiatives of any third party and are not intended to suggest and there is no assurance that, these or any other engagements will be successful and/or result in positive outcomes.

Forward-Looking Statements

Certain statements contained in this document may constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our commitment to achieve Net Zero greenhouse gas emissions before 2050 in our financing activities, operations and supply chain and interim 2030 Net Zero greenhouse gas emissions targets. We use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could” to identify forward-looking statements. Forward-looking statements are not based on historical facts, but reflect management’s current expectations, plans or forecasts, are not guarantees of future results or performance, involve certain known and unknown risks, uncertainties and assumptions that are difficult to predict and often beyond Bank of America Corporation’s control and are inherently uncertain.

You should not place undue reliance on any forward-looking statement. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements due to a variety of factors, including global socio-demographic and economic trends, energy prices, technological innovations and advances, climate-related conditions and weather events, legislative and regulatory changes, public policies, engagement with clients, suppliers, investors, government officials and other stakeholders, the quality and availability of third-party data, including data measured, tracked and provided by data providers, our clients and other stakeholders, our ability to gather and verify data, our ability to successfully implement sustainability-related initiatives under expected time frames, third-party compliance with our expectations, policies and procedures and other unforeseen events or conditions. Discussion of additional factors, including uncertainties and risks, can be found in Bank of America Corporation’s 2023 Annual Report on Form 10-K and subsequent SEC filings. Forward-looking statements speak only as of the date they are made and Bank of America Corporation undertakes no obligation to update or revise any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made.

Last Update: 12/18/2025