Better Money Habits® offers free, easy-to-understand tools and resources that are available to all, helping people make sense of their money and take action to improve their financial picture.

Building financial know-how

Whatever our clients’ backgrounds and ambitions, we offer education and advice that empowers them to build their preferred future. We’re committed to providing extensive, personalized support to help people gain the knowledge they need to make confident financial decisions.

Millions of people access the knowledge every year, and thousands of our employees use the materials in-person with customers in every community we serve.

Better Money Habits®

Better Money Habits® is a free financial education platform for people from all walks of life to get practical, easy-to-understand knowledge about money. With hundreds of engaging videos, articles and resources, available in both English and Spanish, anyone can find precisely the right tools and information for their situation. With topics like budgeting, saving, retirement planning, owning a home and more, the platform helps them put their know-how to use, so that they can make smarter, more-confident financial decisions.

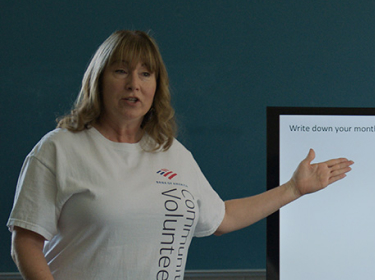

Thousands of our employees also deliver in-person guidance and advice in communities around the country. These Better Money Habits Champions learn about the people we serve, then help them learn about personal finances and how to achieve their individual goals.

Pilot program brings financial education to diverse learners

Bank of America’s longstanding partnership with Special Olympics is helping more people in the communities we serve move ahead.

Discover how our dedicated employees, as Better Money Habits® Volunteer Champions, are making an impact and delivering financial education to Special Olympics athletes.

Financial health for strong futures

We learn about our clients’ unique goals for the future, then we give them the tools to succeed.

Both with online resources and in-person service, we strive to meet individuals, families and small businesses where they are by providing relevant, helpful guidance. We focus on low- and moderate-income (LMI) communities, which are home to about one-third of our banking centers. We want to see more and more people in underserved areas improve their upward mobility.

Our teams know the local landscape in community banks around the country and they’re trained on products and services that will best serve their neighborhoods.

Some examples of how we nurture knowledge and empower our clients:

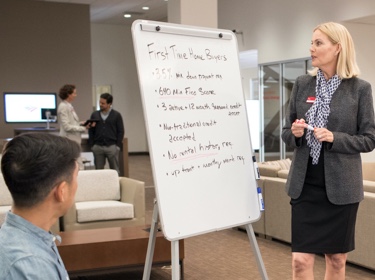

- Aspiring homeowners can learn from our loan officers about budgeting, saving for a down payment and how the mortgage process works.

- Clients can get basic money skills and advice at Better Money Habits workshops held at local branches and other central community locations.

- Carefully crafted products and services, like our Advantage SafeBalance Banking, help save time and money, which is particularly helpful for LMI communities.

- Local entrepreneurs have access to capital and other business-building tools via Community Development Financial Institutions that we partner with nationwide.

- Our site is fully translated into Spanish to reach a broader audience

Better Money Habits

We measured young adults’ attitudes and priorities around money, taking a close look at how these relate to lifestyle choices.

Helping clients achieve their financial goals

For four years in a row, J.D. Power has certified Bank of America for Outstanding Customer Satisfaction with Financial Health Support - Banking & Payments. *

* J.D. Power 2025 Financial Health Support CertificationSM is based on exceeding customer experience benchmarks using client surveys and a best practices verification. For more information, visit www.jdpower.com/awards